All Categories

Featured

Table of Contents

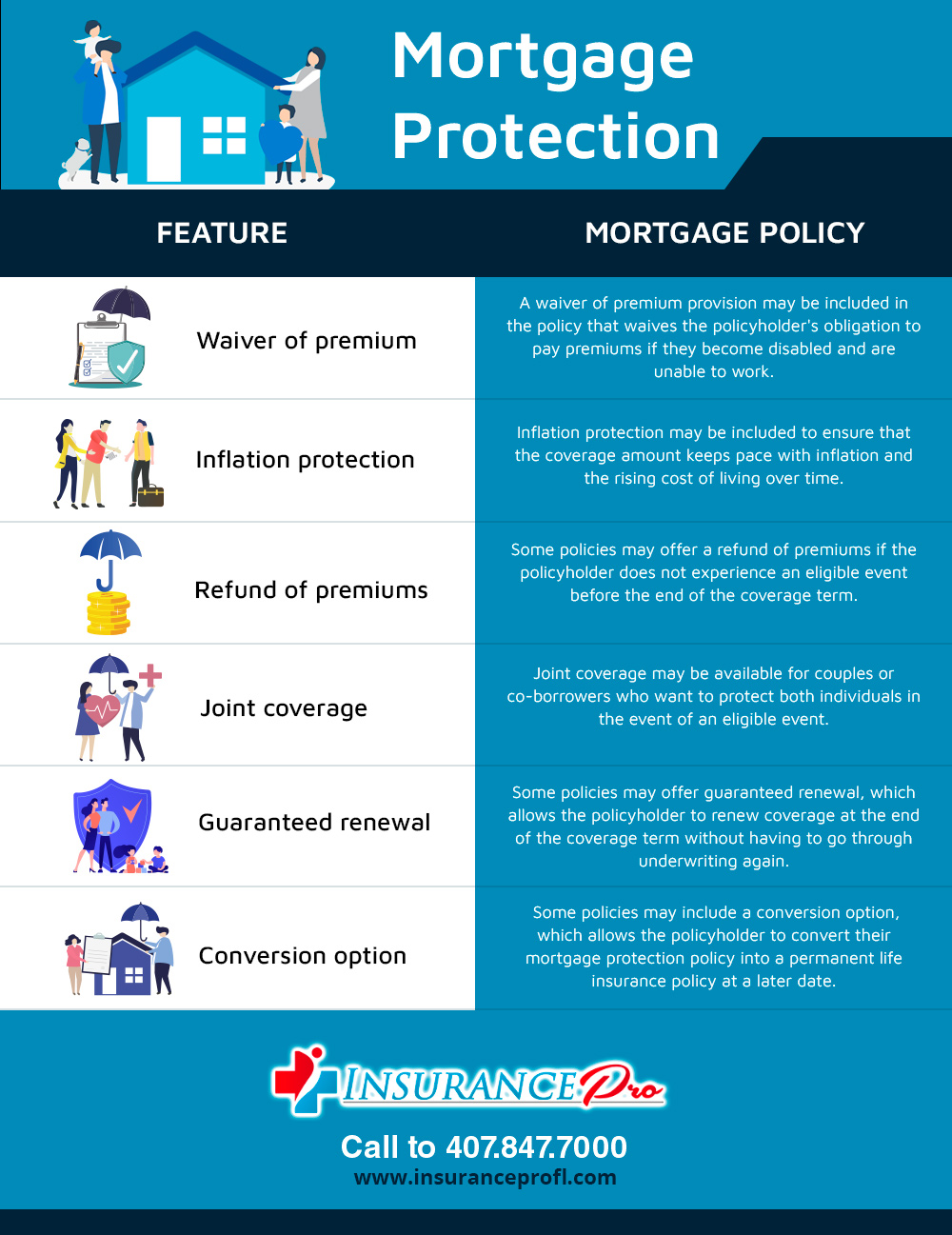

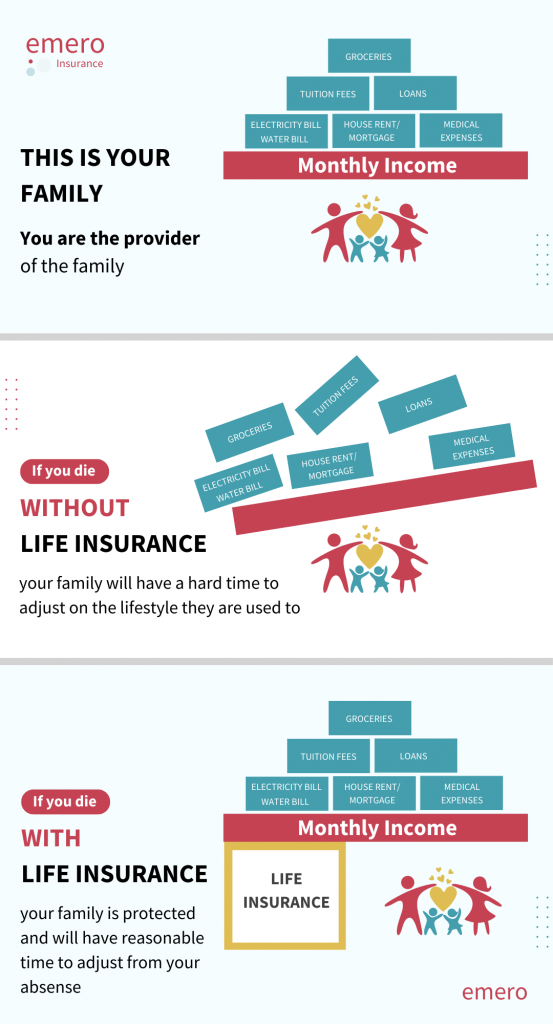

Mortgage life insurance policy supplies near-universal coverage with minimal underwriting. There is usually no medical checkup or blood example required and can be an important insurance plan choice for any type of homeowner with significant preexisting clinical conditions which, would certainly stop them from purchasing traditional life insurance policy. Various other benefits include: With a home mortgage life insurance policy policy in position, successors will not need to stress or wonder what might occur to the family members home.

With the home mortgage paid off, the family will constantly belong to live, offered they can afford the real estate tax and insurance coverage annually. mortgage indemnity fee.

There are a couple of various kinds of home mortgage defense insurance coverage, these consist of:: as you pay even more off your home loan, the amount that the plan covers reduces in line with the superior balance of your home mortgage. It is one of the most usual and the most inexpensive form of home loan protection - american mortgage protection.: the quantity insured and the costs you pay stays level

This will settle the home mortgage and any type of continuing to be equilibrium will certainly go to your estate.: if you want to, you can add severe health problem cover to your home loan security policy. This suggests your home mortgage will be cleared not just if you pass away, yet additionally if you are detected with a major ailment that is covered by your policy.

British Insurance Mortgage Protection

Additionally, if there is an equilibrium staying after the home mortgage is removed, this will go to your estate. If you change your mortgage, there are a number of points to take into consideration, depending on whether you are covering up or prolonging your home mortgage, switching, or paying the home loan off early. If you are covering up your mortgage, you require to make sure that your plan satisfies the new value of your home mortgage.

Compare the prices and benefits of both alternatives (investors mortgage insurance company). It may be less expensive to keep your initial mortgage defense policy and afterwards buy a second plan for the top-up quantity. Whether you are topping up your home loan or extending the term and require to get a new policy, you might find that your costs is higher than the last time you got cover

Do I Have To Buy Mortgage Insurance

When switching your mortgage, you can appoint your home loan security to the brand-new lending institution. The premium and degree of cover will certainly coincide as prior to if the quantity you borrow, and the regard to your home mortgage does not transform. If you have a policy with your loan provider's group plan, your lending institution will cancel the plan when you change your home loan.

In California, mortgage defense insurance policy covers the whole outstanding equilibrium of your lending. The death benefit is a quantity equal to the equilibrium of your mortgage at the time of your death.

Do I Need Life Insurance If I Have No Mortgage

It's vital to comprehend that the survivor benefit is provided directly to your financial institution, not your enjoyed ones. This ensures that the continuing to be financial obligation is paid in complete and that your enjoyed ones are spared the monetary stress. Mortgage security insurance policy can likewise provide short-lived insurance coverage if you become impaired for a prolonged duration (normally six months to a year).

There are numerous advantages to obtaining a home mortgage defense insurance coverage plan in California. Several of the leading advantages include: Ensured authorization: Also if you're in poor health and wellness or operate in a dangerous career, there is ensured approval with no medical examinations or lab examinations. The exact same isn't true forever insurance coverage.

Disability protection: As mentioned over, some MPI plans make a few mortgage settlements if you end up being impaired and can not generate the same revenue you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all different kinds of insurance coverage. Home loan security insurance coverage (MPI) is designed to pay off a home mortgage in situation of your fatality.

Life Insurance When Taking Out A Mortgage

You can also apply online in mins and have your plan in location within the exact same day. To find out more about obtaining MPI coverage for your home loan, contact Pronto Insurance today! Our knowledgeable representatives are here to answer any questions you might have and offer additional assistance.

MPI uses several benefits, such as peace of mind and streamlined credentials procedures. The fatality benefit is straight paid to the loan provider, which restricts flexibility - mortgage free home protection. Furthermore, the advantage amount lowers over time, and MPI can be a lot more costly than basic term life insurance coverage policies.

Insurance Pay Off Mortgage Upon Death

Get in fundamental information concerning yourself and your home loan, and we'll compare prices from various insurance companies. We'll also show you how much coverage you require to safeguard your home mortgage. Get started today and offer yourself and your family members the peace of mind that comes with understanding you're shielded. At The Annuity Expert, we comprehend property owners' core trouble: ensuring their family members can keep their home in the occasion of their death.

The major advantage here is quality and self-confidence in your choice, knowing you have a strategy that fits your requirements. As soon as you accept the plan, we'll manage all the paperwork and configuration, making sure a smooth execution procedure. The favorable outcome is the peace of mind that features recognizing your family members is safeguarded and your home is safe and secure, regardless of what happens.

Professional Guidance: Guidance from skilled experts in insurance policy and annuities. Hassle-Free Arrangement: We take care of all the paperwork and execution. Economical Solutions: Finding the very best protection at the most affordable feasible cost.: MPI specifically covers your home loan, providing an extra layer of protection.: We work to find one of the most affordable remedies tailored to your spending plan.

They can offer details on the protection and benefits that you have. On standard, a healthy person can expect to pay around $50 to $100 each month for home mortgage life insurance policy. Nonetheless, it's recommended to acquire an individualized home loan life insurance policy quote to obtain an exact estimate based on specific conditions.

Latest Posts

Best Term To 100 Life Insurance

Life Insurance And Protection Plan

Renowned Level Term Life Insurance