All Categories

Featured

Table of Contents

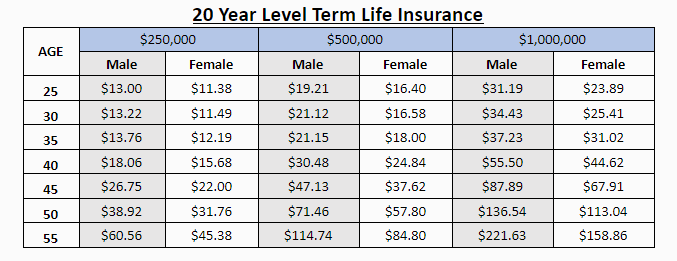

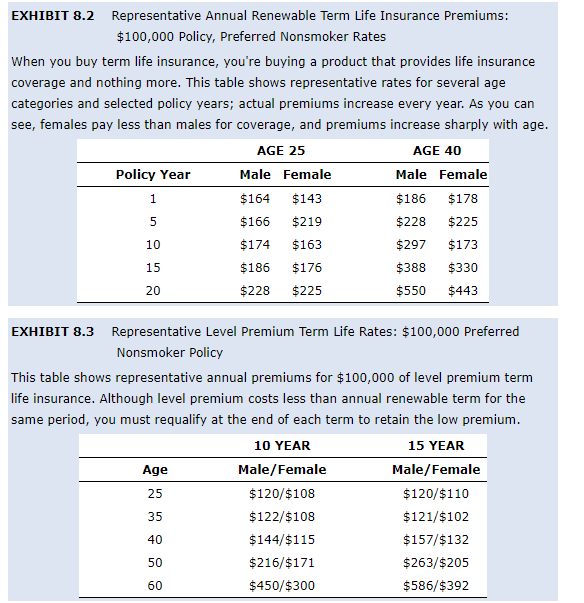

A level term life insurance plan can give you comfort that individuals who rely on you will certainly have a death advantage during the years that you are planning to support them. It's a means to aid care for them in the future, today. A degree term life insurance policy (in some cases called level costs term life insurance policy) plan provides protection for a set variety of years (e.g., 10 or twenty years) while keeping the premium payments the same for the period of the policy.

With level term insurance, the expense of the insurance policy will remain the exact same (or possibly lower if dividends are paid) over the term of your plan, usually 10 or 20 years. Unlike irreversible life insurance policy, which never expires as lengthy as you pay premiums, a degree term life insurance policy will finish eventually in the future, typically at the end of the duration of your degree term.

Is Term Life Insurance a Good Option for You?

As a result of this, lots of people utilize long-term insurance as a stable economic planning tool that can offer numerous needs. You may have the ability to convert some, or all, of your term insurance coverage throughout a collection duration, usually the very first one decade of your plan, without needing to re-qualify for coverage even if your wellness has changed.

As it does, you might desire to add to your insurance coverage in the future - Term life insurance for spouse. As this takes place, you may want to eventually decrease your fatality benefit or consider transforming your term insurance coverage to a permanent policy.

Long as you pay your costs, you can relax simple understanding that your liked ones will certainly get a death advantage if you pass away during the term. Numerous term plans allow you the capacity to convert to long-term insurance without having to take an additional health and wellness examination. This can permit you to take advantage of the fringe benefits of an irreversible policy.

Level term life insurance policy is one of the most convenient paths into life insurance coverage, we'll discuss the benefits and downsides to make sure that you can choose a strategy to fit your needs. Level term life insurance policy is one of the most typical and fundamental kind of term life. When you're trying to find short-lived life insurance plans, level term life insurance is one course that you can go.

The application process for degree term life insurance policy is normally really simple. You'll fill in an application that consists of basic personal info such as your name, age, etc as well as a more thorough set of questions concerning your clinical background. Relying on the policy you have an interest in, you may have to join a medical examination procedure.

The brief solution is no., for example, let you have the comfort of death benefits and can accrue cash value over time, indicating you'll have much more control over your advantages while you're alive.

30-year Level Term Life Insurance Explained

Cyclists are optional arrangements added to your policy that can give you extra advantages and protections. Anything can occur over the training course of your life insurance term, and you want to be all set for anything.

There are circumstances where these benefits are constructed right into your plan, however they can likewise be readily available as a separate enhancement that needs extra payment.

Latest Posts

Insurance To Cover Burial Expenses

Cheapest Funeral Policy

Burial Insurance For Parents